Institutes |

Robin Against the Output Gap

Sottotitolo:

Rather than Robin Hood, our hero is the financial analyst Robin Brooks, who from the heart of the institutions of power is waging a campaign against using dubious estimates to make judgments on budgetary policies. Forget Robin Hood. Our hero is Robin Brooks. He’s not a rebel who hides in Sherwood Forest, on the contrary: he’s – just imagine – a mainstream economist. He graduated from Yale, got a master’s degree from the London School of Economics, then worked at the International Monetary Fund for 8 years before going on to Goldman Sachs. Now he is chief economist at the Institute of International Finance (IIF), which may not be well known by the general public, but it is one of the most important lobby organisations of the financial institutions: it represented the banks in the negotiations on the Basel 3 regulation and the creditors against Greece in 2011-12. In short, a character who moves in the corridors of power – the real power. And why do we like him so much? Because he initiated a campaign against the use by the European Commission and the International Monetary Fund, of the output gap, which is one of the mechanisms used to make judgments on a country’s economy and decide the limits of its budgetary policy. Brooks even coined an acronym, CANOO, which stands for Campaign against Nonsense Output Gaps, and produces graphs that show that this parameter is completely out of control and its use has devastating effects on economic policies. Before showing you the graphs, let’s briefly remind you of what an output gap is. When a nation is in recession, the vast majority of economists, albeit with various nuances, agree that fiscal policy must be expansive, that is, the State must spend more to support the economy. In past years there was no such broad consensus – that is another story that would be too long to tell. But we are only at the beginning of the problem, because, according to the dominant economic theory, higher expenditure can only have a positive effect when the country in question is below its potential GDP, that is, what would be obtained if all the factors of production – labour and capital – were used to best effect. Otherwise, that higher expenditure would only increase debt and trigger inflation. It is therefore fundamental, in this situation, to calculate the difference between actual and potential GDP: this difference is precisely the output gap. If it is negative, it means that the economy is not performing as it should, and in this case greater public spending is allowed, even in deficit; if, on the other hand, it is positive, the greater spending – again according to these theories – would not only not help the economy, but would even do damage. But how is the potential GDP calculated? On the basis of estimates of a series of variables that need to be calculated, and already here the alarm bells are ringing, because in the past we have seen how wrong these estimates have been. The IMF – considered one of the most technically adept financial institutions in the world – has made an incredible number of mistakes: on crisis forecasts the error rate is as high as 100%. We shall not mention the other forecasters. Not only that: another fundamental variable in that calculation is the level of unemployment below which the pressure on wages would increase (Nairu: Non-Accelerating Inflation Rate of Unemployment), which would have inflationary effects. We have already observed that a theory that considers unemployment desirable is ethically unworthy. But it is also technically unsound, because it is actually a sort of moving average derived from the unemployment of previous years. So, the more serious the crisis, the higher this unemployment figure will be and the smaller the output gap will be. And since this is the basis on which you decide what budgetary policy to use, the mechanism has the effect of further curbing the economy instead of supporting it. What a masterpiece! Now, if these things are said by a simple journalist, such as the author; or if these things are said by the economists who are defined as “non-aligned”, “critical”, “radical”, the insinuation is that they are not reliable. As long as only these kinds of people say this, financial institutions can pretend that the problem does not exist. But if someone like Brooks, who works in institutions that are the heart of the ruling class, says it, well, then if they continue as if nothing were wrong it means that we are outside of mainstream economics, and are instead purely and simply in the field of politics: a politics that uses formulas to try to justify its ends, which are those of one side only – the lords of turbo-capitalism. Those who agree with Brooks’ campaign include Adam Tooze, professor of history at Columbia University (but scholar of economic problems, author of Crashed: how a decade of financial crisis has changed the world); Adam Posen, president of the Peterson Institute for International Economics; Paul Krugman and other economists who wrote it on Brooks’ Twitter profile (@RobinBrooksIIF), declaring their endorsement. Let’s see now some of the graphs with which Brooks shows the senselessness of the output gap. In fact, let’s start with Nairu, which as we said counts a lot in the calculation.

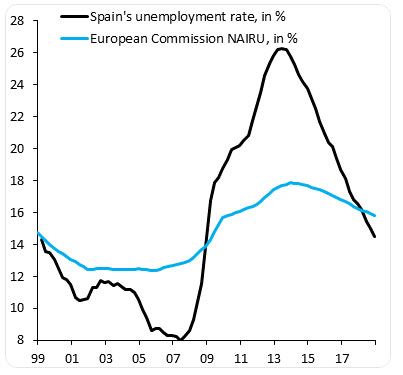

Brooks remarks: “The European Commission’s Nairu estimate for Spain is higher than 10 years ago and says the labour market is now tight” (with unemployment is at 15%!, my note). The difference with many other countries, where Nairu has fallen, is striking. Why not in Spain?”. We can add that the estimated Nairu for Italy is close to the unemployment rate that actually occurs. In other words, the balance of our economy, according to the Commission, leads to a double-digit unemployment rate. Does this need further comment? And let us come to the output gap.

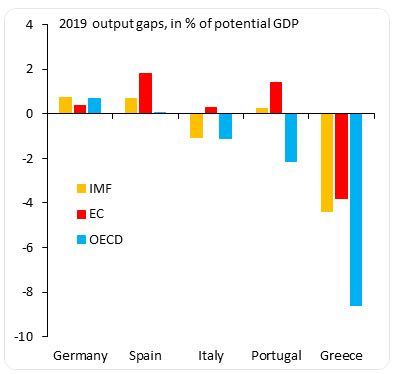

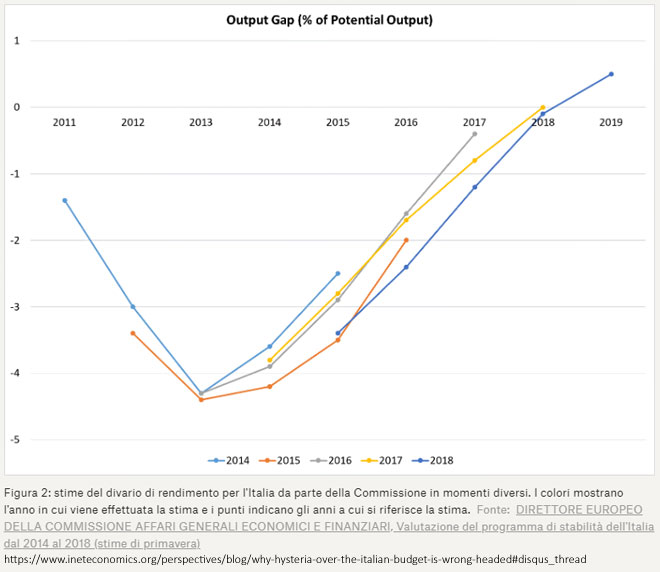

A first observation is that the estimates of the three most important institutions of analysis are different from each other, showing how much the result depends both on the methodology chosen and on the hypothesis on the variables to be estimated. However, we can see that in four out of five cases, the Commission’s accounts diverge markedly, and its results mean that the budget policy should be more restrictive than for the other two forecasts. Brooks criticises the fact that EU Commission estimates the gaps in Spain and Portugal to be greater than it is in Germany, and he is quite right. But what about Italy, which, according to the Commission, is growing more than its potential? This is an absurdity that we had already pointed out in the article According to the EU accounts we are growing too much, showing the graph with the evolution of EU estimates.

The European Commission is the least reliable, but Brooks also criticises the International Monetary Fund.

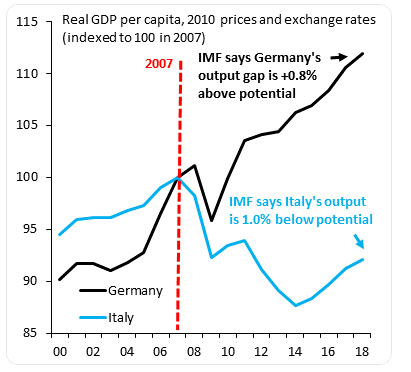

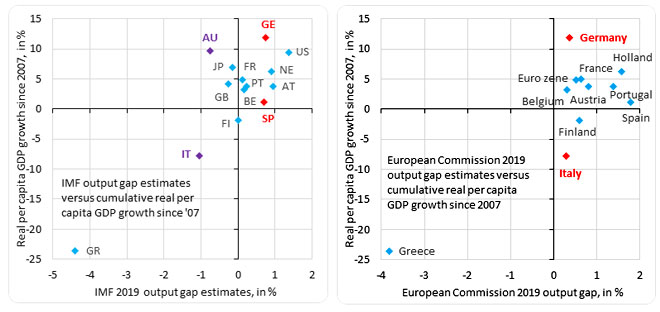

Is it possible that there is such a small difference between the gaps in Italy and Germany, Brooks asks? No, he continues, it is not possible, given that the real GDP per capita of Germany is now 12% higher than in 2007, while that of Italy is 8% lower. “IMF output-gap estimates normalise a decade of stagnation on the periphery and underwrite policies that are leading to unsustainable divergence within the currency union”.

At least, according to the IMF, Italy still has a negative gap, albeit a small one, while, as we have just seen, according to the Commission it is positive. Let us see a comparison of the estimates of the two institutions on various countries.

The few countries below the horizontal line are those with a real GDP per capita lower than 2007, while those to the right of the vertical line have a positive output gap, i.e. they are growing above their potential. The most striking thing is that – according to the Commission’s accounts – EVERYONE, except Greece, is above potential. In short, even if we hadn’t noticed, and even if the growth estimates have been revised downwards several times, these calculations say that the European economy is in a phase of overheating: listening to the Commission, the ECB should raise rates and budget policies should be restrictive, to curb the impetuous flow of excessive growth. Unfortunately, this can only be seen in the results of that absurd procedure. Italy has long disputed these calculations. The former Minister of the Economy Pier Carlo Padoan, who one can criticise for many things, but not for being unfamiliar with these matters, explained this in an official document, the Programmatic Budget of 2015, which was sent to the European Commission. Consequences? None. At least, there was a decision to form a technical working group to examine the problem, but there is no trace of this group. Even today, four years later, the Commission continues undaunted to use the output gap, based on that methodology, to give its opinion on the Italian public accounts and establish how our budget should be planned. A previous study by the Commission itself in 2013, concluded that the method is not reliable, which was also noted by an “Occasional paper” of the ECB and then by its President Mario Draghi in a speech at Jackson Hole the following year. Even before that, it was the Centro Europa Ricerche, an important Italian think-tank, that highlighted these inconsistencies. Anyway, if the Commission continues to use a completely discredited method, the reason can only be political. The fact that the use of the output gap has been introduced is to be welcomed. It is right to take into account the economic phase when assessing the appropriateness of budgetary policy. But a methodology should be developed which does not require too many arbitrary estimates and which is not based on a theory that considers a certain level of unemployment positive. What we have seen so far is that the ruling classes want to continue to use the wrong method to justify the continuation of policies that are not only reactionary but wrong. We hope that the campaign of our Robin-Hood-Brooks, which comes from within the institutions controlled by those same ruling classes, will be successful. Carlo Clericetti

Giornalista - Collaboratore di "La Repubblica.it." Membro dell'Editorial Board di Insight. Blog: http://www.carloclericetti.it Insight - Free thinking for global social progress

Free thinking for global social progress |