Institutes |

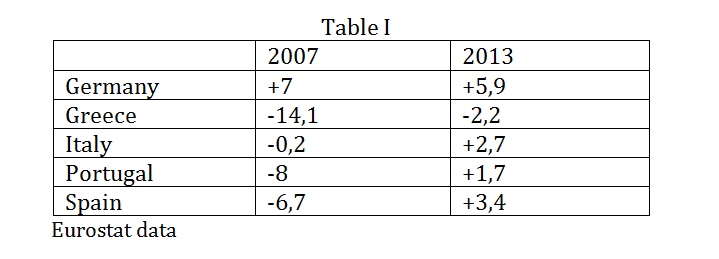

Export-import in EurosudAfter the financial crisis, in "virtuous" countries like Germany, concerns have arisen about the imbalances in the trade balances of the countries of the south, who, living beyond their means like the grasshopper of Aesop’s fable, absorb the savings of virtuous Nordic “ants”. Of course, these concerns were not expressed before 2008, when the German banks willingly lent hundreds of billions to the "pigs" southerners. Although the rules of the fiscal compact focused on the public budget, the trade balance is considered a crucial variable, and it is explicitly mentioned by the European Commission among the macroeconomic imbalances. Table I shows the balances of trade balances of Germany and of the four Eurosud countries, in percentages of GDP:

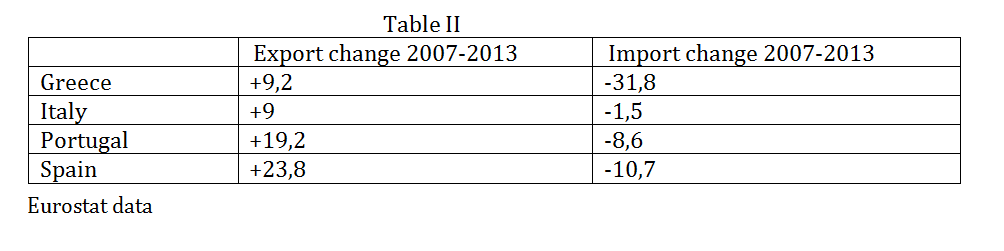

As you can see in 2007 the imbalances were very marked, apart from Italy: in front of a gigantic surplus of Germany there were significant deficits of Greece and Iberian countries. After six years the situation has changed. German surplus has narrowed only slightly as a result of lower demand from countries Eurosud, while the adjustment of these countries has been remarkable: about a ten-points improvement in the Iberian countries, twelve Greece. The Italian adjustment was minor, because the imbalance was significantly lower. It is interesting to see how the adjustment of the countries Pigs has occurred from the two sides: exports and imports. Table II shows the percentage changes in exports and imports in the six years: Spain and Portugal have made a significant adjustment, trying to compensate for the fall in domestic demand with export, in a situation of overall GDP contraction along the six years: -4.9 Portugal, Spain -6). The question is if it is possible to continue on this path. That is, with the compression of domestic demand and rising export, by applying the model of export-led Germany to countries Eurosud. Yes, replied the European Commission and the IMF; most recently Commissioner Olli Rehn has taken the suggestion of the IMF, proposing a cut in nominal wages in Spain of 10%. It may be that Rehn is more expert of football than of macroeconomics, but should know that the share of Spanish exports to GDP is 34%, while 58% that of household consumption. It is clear that with this type of policies Eurosud countries will face a long lasting stagnation. It is not difficult to prophesy the end of the single currency. Ruggero Paladini

Economist - Professor of "Scienza delle Finanze" at University "La Sapienza" Roma; Member of the Economic Board of Insight - ruggero.paladini@uniroma1.it |

As you can see for Italy, Portugal and Spain the adjustment took place more on the export side than from that of import. In fact the trend in import was characterized by a sharp fall in 2009, the year of global recession, when even oil prices have fallen significantly. Subsequently there has been a recovery in import in the following years and then a second braking, with the price of oil settled steady at above 110 dollars a barrel. In Italy's case there was a difference: in the 2010-11 Italian imports moved up by 29.8% and then decreased by 6.9% in 2012-13. The strong rise is explained by massive imports of solar panels and wind turbines that occurred in that period, to earn the incentives existing at that time. In the case of Greece, however, the adjustment took place mainly by the fall in imports, due to the collapse of income that has occurred in all six years (the Greek GDP decreased by 23.4%).

As you can see for Italy, Portugal and Spain the adjustment took place more on the export side than from that of import. In fact the trend in import was characterized by a sharp fall in 2009, the year of global recession, when even oil prices have fallen significantly. Subsequently there has been a recovery in import in the following years and then a second braking, with the price of oil settled steady at above 110 dollars a barrel. In Italy's case there was a difference: in the 2010-11 Italian imports moved up by 29.8% and then decreased by 6.9% in 2012-13. The strong rise is explained by massive imports of solar panels and wind turbines that occurred in that period, to earn the incentives existing at that time. In the case of Greece, however, the adjustment took place mainly by the fall in imports, due to the collapse of income that has occurred in all six years (the Greek GDP decreased by 23.4%).