Sottotitolo:

Comparing the trend of unemployment among the euro-zone and the United States, Draghi stresses the difference in setting fiscal policy. But the conclusion, in conformity to the German path to growth, is wage deflation and export-led model for everybody in Euro-zone.

The intervention of the President of the ECB at Jackson Hole, and the paper published, with some modifications, on the website of the bank have attracted many comments, between enthusiasm and perplexity. I try before to summarize Draghi’s intervention, then move on to comments.

1. The paper begins by describing the long recession of the euro area, comparing the trend of unemployment among the euro-zone and the United States. Draghi stresses the difference in setting fiscal policy; in Europe “fiscal policy was constrained by concerns over debt sustainability and the lack of a common backstop, especially as discussions related to sovereign debt restructuring began…Sovereign pressures also interrupted the homogenous transmission of monetary policy across the euro area. Despite very low policy rates, the cost of capital actually rose in stressed countries in this period, meaning monetary and fiscal policy effectively tightened in tandem. Hence, an important focus of our monetary policy in this period was – and still is – to repair the monetary transmission mechanism”.

Draghi then goes on discussing the cyclical and structural factors that affect the phase of stagnation: “cyclical factors have therefore certainly contributed to the rise in unemployment. And the economic situation in the euro area suggests they are still playing a role....That being said, there are signs that, in some countries at least, a significant share of unemployment is also structural”.

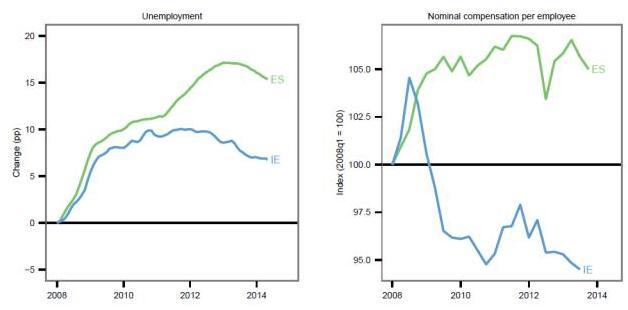

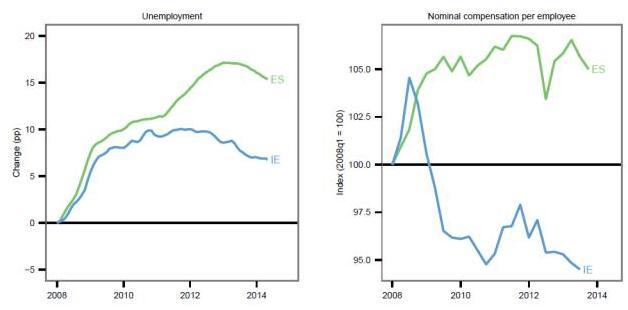

The paper presents the graphs of the Beveridge curve (the negative relationship between the unemployment rate and the vacancy rate in relation to the labour force), which shows the shifts to the right, where, says Draghi, also play sectorial effects such as the collapse the of construction sector, in particular in Spain. There are significant differences between different European countries, and it is likely that the estimates of NAWRU (non-accelerating wage rate of unemployment) exaggerate the level of structural unemployment, especially in countries most affected by the crisis. But a significant weight is represented by the institutional arrangements in the labour market. Draghi presents two graphs showing the changes in unemployment (left) and nominal wage (right) for Spain (ES) and Ireland (IE). Wage flexibility in Ireland has resulted in a weaker trend in unemployment, trend that in Ireland begins to decline two years before than in Spain (http://www.ecb.europa.eu/press/key/date/2014/html/sp140822.en.html)

“To sum up, unemployment in the euro area is characterised by relatively complex interactions. There have been differentiated demand shocks across countries. These shocks have interacted with initial conditions and national labour market institutions in different ways … But it is clear that such heterogeneity in labour market institutions is a source of fragility for the monetary union…So what conclusions can we draw from this as policymakers? The only conclusion we can safely draw, in my view, is that we need action on both sides of the economy: aggregate demand policies have to be accompanied by national structural policies”. In current conditions the risk of "doing too little," meaning that cyclical unemployment becoming structural, prevails over that of "doing too much", that is, excessive upward wage and price pressures. Therefore Draghi announced that the ECB is preparing the purchase decision of ABS (asset-backed security) to complement the operations of TLTRO (Targeted Long-Term Refinancing Operation) already decided. And in september ECB decided just in this way.

Regarding fiscal policy, Draghi emphasizes a point already mentioned, namely, that in the euro-area, despite a level of debt not higher than Japanese or American, it was not possible to act as the USA or Japan, where the central banks have acted as a backstop for the public funding. “Thus, it would be helpful for the overall stance of policy if fiscal policy could play a greater role alongside monetary policy, and I believe there is scope for this, while taking into account our specific initial conditions and legal constraints. These initial conditions include levels of government expenditure and taxation in the euro area that are, in relation to GDP, already among the highest in the world. And we are operating within a set of fiscal rules – the Stability and Growth Pact – which acts as an anchor for confidence and that would be self-defeating to break”.

According to Draghi also in the short term there is scope to reach a settlement more favorable to the growth of budgetary policies. This is to lower the tax burden and public spending by the same amount. This strategy can have positive effects if taxes are lowered in those areas where the fiscal multiplier is higher, and the cost cut in unproductive areas in which the multiplier is lower. "Thirdly, in parallel may be helpful to have a debate on the overall fiscal stance of the euro area. Unlike other major advanced economies, our fiscal policy is not based on a single budget voted by a single parliament, but on the aggregation of eighteen national budgets and the EU budget. Stronger coordination between the different national tax positions should, in principle, possible to achieve a fiscal policy more favorable to the overall growth for the euro area. Fourth, further action at EU level would also seem to be needed to ensure both an appropriate aggregate position and a large public investment program - which is consistent with the proposals of the incoming President of the European Commission. "

Draghi then passes to the need for supply-side reforms, " No amount of fiscal or monetary accommodation, however, can compensate for the necessary structural reforms in the euro area". There is a need of acting on the labor market, on product market and on the environment in which businesses operate. As for work, it is necessary that workers will move quickly to new job opportunities, that agreements at the enterprise level can reflect the terms of the productivity of the local market, allowing greater wage differentiation between sectors and workers. Also important are policies to improve the level of human capital. “Let me conclude. Unemployment in the euro area is a complex phenomenon, but the solution is not overly complicated to understand. A coherent strategy to reduce unemployment has to involve both demand and supply side policies, at both the euro area and the national levels. And only if the strategy is truly coherent can it be successful”.

2. Now my comments. The analysis of the causes of the crisis of the euro-zone, and of the divergence of the trend of unemployment than the United States, differs from the current one in Germany. The crisis didn’t originate from the public debt, which rised a consequence. It was the bursting of the financial bubble and real estate, together with the lack of the typical role of a central bank, namely the role of lender of last resort. A policy to support demand-side at the euro-zone and "common backstop" would have avoided the divergence compared to the USA. However, even if with delay, it was the same Draghi who created the backstop. But the president of the ECB shares the Community view of the need for orthodoxy full flexibility of the labour market, with the elimination of those regulations that prevent full flexibility of wages.

Since in his paper Draghi shows the difference between flexibility of Ireland and rigidity of Spain (at least until 2011), we should have a further look about these two countries. First, it can be seen that, compared to 2008, when the crisis broke out, in five years the GDP fell a little more in Spain (-7.6) than in Ireland (-5.5). On the other hand, the public debt rose in Ireland (+59.3), because of banks bail-out, much more than in Spain (+39.9). The share of the wage compensations to GDP has fallen in almost equal measure, by almost four points (-3.8 in Ireland, 3.9 in Spain). However, in the first quarter of this year Ireland has had an increase of 2.7% of GDP, while that of Spain was only 0.4%.

What is the fundamental difference between Irish and Spanish economies? In 2013, Irish exports arrived at 107.7% of GDP, an increase of 24.4 percentage points compared to 2008; Spain's export share in 2013 amounted to 34.1%, a good increase, but still the share is about a third of GDP. In other words, in Ireland, domestic demand has a much smaller role than it is true in Spain. Before the Iberian country can become export-led economy, whenever possible, it will last a lot of time.

Turning to monetary policy, the ECB in September gave a strong boost with the decrease of interest rates and the launch of ABS. The immediate effect was that of a decline in the dollar-euro rate below 1.3, with favourable effects on extra-EU exports and the tendency to deflation. The purchase of ABS allows banks to increase their capital, and then loosen the constraints of Basel. With regard to the propensity of firms to borrow, the problem remains that of the expected demand, and this in turn depends on fiscal policy. Draghi said that the rules of the fiscal compact should be respected because they give confidence to financial markets, but something can done without changing the fiscal balance. Unfortunately, the tax reduction has a lower multiplier of the investment expenditures; so in theory we should raise taxes to finance expenditures, not the other way round. As for the idea that spending "unproductive" (what, exactly?) has a lower impact on demand, this is one of those statements easy to make but difficult to prove. And anyway, it is better not to expect much by a manoeuvre of balanced budget.

So we are back at the problem of public deficit. Very cautiously Draghi suggests that countries with better economic conditions should be more expansive, and also action at Community level would be welcome. The answer, I think, is already reached by the decisions of the Bundestag, unanimously, on a balanced budget for the next two years; and the statements of Frau Merkel, proud of the fact that Germany has already achieved a balanced structural, and that she expects that other countries will do their part. This with regard to the flexibility allowed by the rules of the fiscal compact.

The Italian Prime Minister Renzi complains because the country is already at 3% deficit, while Ireland and Spain this year will respectively, according to the Commission, have 7.2 and 5.6, and and 6.9 and 6.1 in 2015. The answer is that in Ireland the labour market is perfectly flexible from a long time, while Spain is just behind. Italy must imitate these countries, and the same goes for France. The point is simple: in both countries the wage compensations to GDP has risen over the past five years of 0.9 (Italy) and 1.2 (France) points. These percentages must come down, as in Ireland and Spain, and export shares (30.1 in Italy and 27.2 in France) have to rise. Wage deflation and export-led model for everybody in Euro-zone. This is the German path to growth.

And what about Junker’s 300 billions? We will get them, in the long run. But it seems to me that Keynes made an interesting observation about what happens in the long run.